Welcome to the world, BIV Fund II

Welcome to the world, BIV Fund II. To those who follow our Monthly Updates, this has obviously been in the works for some time but there is a helpful finality to have it out in the public realm. We are all delighted to continue the work of Fund II, investing into this foundational, massive and fast-growing market, backing extraordinary founders to build companies that matter.

This was a tough one. You only need to look at the graph of managers who have raised a second fund in recent times, let alone those in or around the climate issue, to see that we should be proud of what we just did. Not many managers have put a second Fund in place, especially one 66% larger than the first.

Fortune has indeed smiled. We have exceptional anchor investors in Xylem and WovenEarth (top life tip - find yourselves partners like Sivan, Mac, Jane, Denise and their teams). We had a phenomenal proportion of Fund I investors that followed us to Fund II pre-DPI in an environment where that was not the norm. We had new investors through so many avenues, from the wonderful folks at Cambridge Associates putting us through their process, to the Dutch family office who definitely didn’t think their first GP relationship in their Fund-of Funds would be a Fund II focused on water. To all of you who have entrusted us with your capital - thank you. We think you’re very wise. And kind. And good-looking.

This Fund is important. We needed to continue what we started in October 2020, proving that a Seed Fund in water was a great idea in terms of both returns and impact. Fund I is well on its way to doing that (top decile for the 2021 vintage), but repeatability really matters. And it doesn’t just matter to us as a firm - it’s vital in terms of how we’re responding to a heating climate.

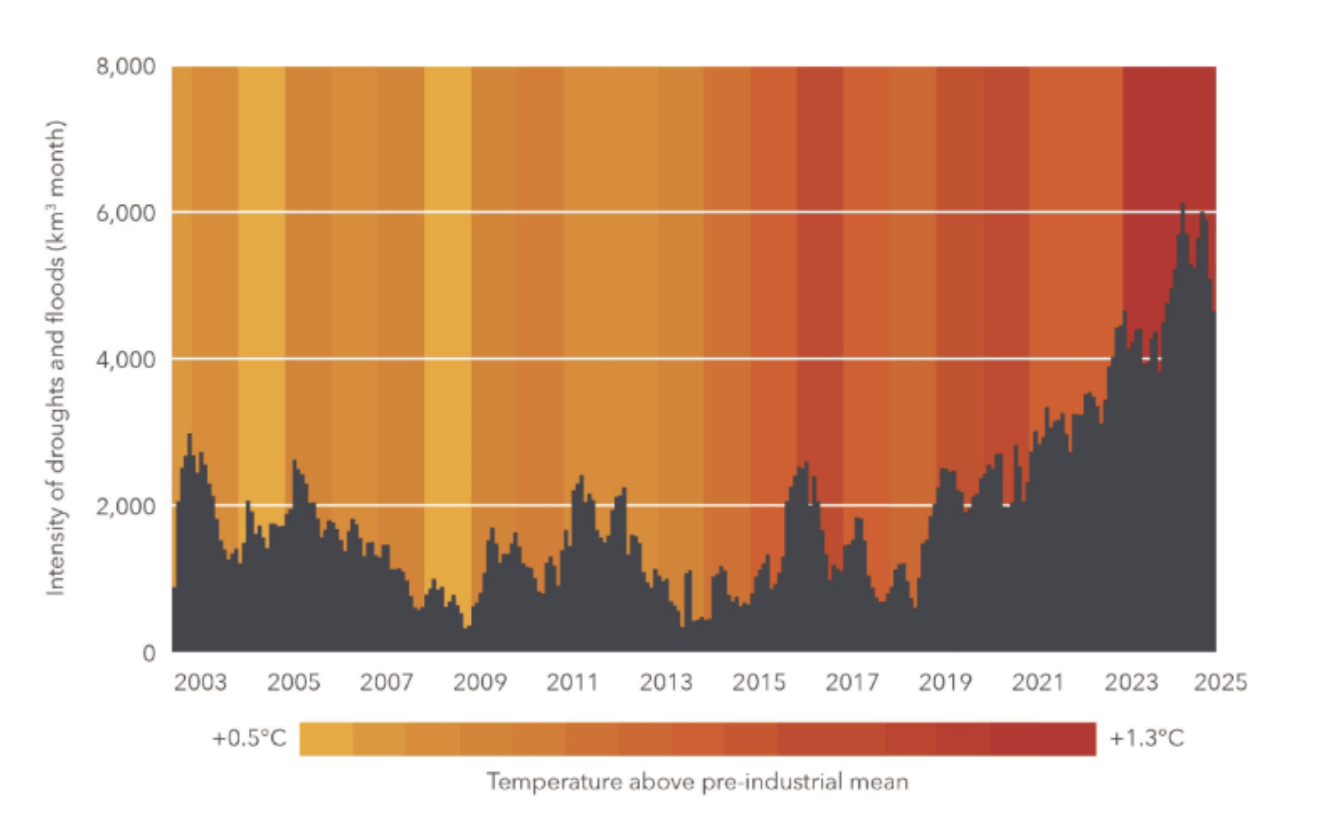

Consider this chart. This is the increase in incidents of expansion or contraction in subsurface water resurfaces (as measured by NASA by their gravitational field) more than one standard deviation from the mean. The grey bars are the number of outliers in terms of flooding or drying events, relative to how hot the earth is getting. If the grey bars are climbing, it’s because the variability and extremity of water-related events is increasing.

You do NOT want that line going up at more than 45 degrees, which starting in 2018 it does. This is what we mean when we say climate change is water change. The implications of this chart are what you are increasingly seeing in the newspaper - the potential need to relocate Tehran, the drying of European rivers, the impact of droughts on municipal budgets, flash floods in Texas, the impact & power of Hurricane Melissa, Typhoon Kalmaegi and on and on.

We need technology to insulate us from these implications, and the capital markets are not rising to the challenge, not in the bond markets and certainly not in venture - let alone climate venture. There are no partnerships in venture, outside of our fellow specialists, that have depth of competence in water. As a result, water deals rarely find their way through the VC selection process.

The ramifications of water not being in the circle of competence of VCs is that we are unprepared for what’s inevitably coming our way. And VCs haven’t brought water into their circle of competence, either by hiring or by doing the work, because they don’t think it’s worth it in terms of returns (or it just hasn’t occurred to them). Just look at the numbers:

Water is partially embedded across here, but is less than 1.5% of the total so it doesn’t come close to showing up on the chart.

The most systemically impactful thing we can do is to prove that our Fund I performance is not a fluke. We have had only one zero in 4.5 yrs, and the portfolio will do $85m in revenue this year, $120m in bookings. This is a very strong list of companies:

If we get Fund II right, it will join Fund I in showing that investing in the technological underpinnings of the water and wastewater resiliency of humankind is a very good economic idea.

And we feel really good about Fund II. At the end of this piece, we’re including a list of all of our investments in the Fund since our first close so you can see the breadth and quality. The 15 companies we’ve invested in will do $55m in revenue this year. Only one is pre-revenue. They set a new standard everywhere from desalination, to utility financial management, to supply chain visibility, to urban water access, to water heating, to sonically-assisted electrocoagulation.

The exit market is waiting. At the start of 2025, I predicted three billion dollar plus deals in water in 2025. As of writing, we’re at eight platform-scale deals and counting, not including the $63bn merger of two of the US’s most significant utilities this week, or Xylem’s sale of the international business of Sensus last month. Our confidence in the exit market is why we’re raising our first Growth Fund (of which more in a separate piece). Funds I and II are establishing companies that will (and do) have a line round the block if and when they grow big enough. This is what a technology category beginning its move up the S Curve looks like.

We’re so grateful our investors took the time to look at the evidence, and back our activities with their capital. They saw what we see. We’re operating in a $1.6trn, completely non-discretionary market that is growing 10% per year. Water’s fundamentals bear little relation to the business cycle. Utility revenue is predictable and recurring. Industrial spend in the age of repatriation of capacity is exploding. Developed market infrastructure has aged out, and emerging market infrastructure to a large extent hasn’t been built yet. As people move out of poverty, they want their water and wastewater issues solved first (can’t argue with Maslow). You don’t have to look far to find massive tailwinds, from the inability of insurers to underwrite in the age of global heating, to the issue of urban pipe replacement, to the litany of applications of highly accurate, vertical AI.

From everyone on the Burnt Island, founders and team members alike - thank you for reading, and thank you for your support. We’re so excited to have Fund II complete. Water needs it.